The Facts About San Diego Home Insurance Uncovered

Wiki Article

Remain Prepared for the Unanticipated With Flexible Home Insurance Policy Options

The ability to customize coverage to your details needs and conditions gives a feeling of security that is both calming and sensible. Stay tuned to uncover the key techniques for ensuring your home insurance lines up perfectly with your progressing requirements.Importance of Flexibility in Home Insurance Coverage

Versatility in home insurance policy is important for accommodating diverse requirements and ensuring thorough coverage. House owners' insurance coverage requires vary extensively based on variables such as residential or commercial property type, location, and individual situations. Customizing insurance policies to specific needs can provide comfort and economic security despite unforeseen events.One key element of versatile home insurance is the capacity to customize insurance coverage restrictions. By adjusting protection degrees for home, personal effects, obligation, and additional living expenses, homeowners can guarantee they are properly secured without overpaying for unnecessary protection. For instance, home owners in risky areas might select to raise insurance coverage for natural catastrophes, while those with useful individual possessions might go with greater personal building limitations.

Moreover, adaptability in home insurance reaches policy options and endorsements. Insurance holders can pick from a range of add-ons such as flood insurance, identity theft defense, or devices break down coverage to enhance their defense. By providing a selection of alternatives, insurance companies empower home owners to construct an extensive insurance policy package that straightens with their unique requirements and choices.

Tailoring Insurance Coverage to Your Requirements

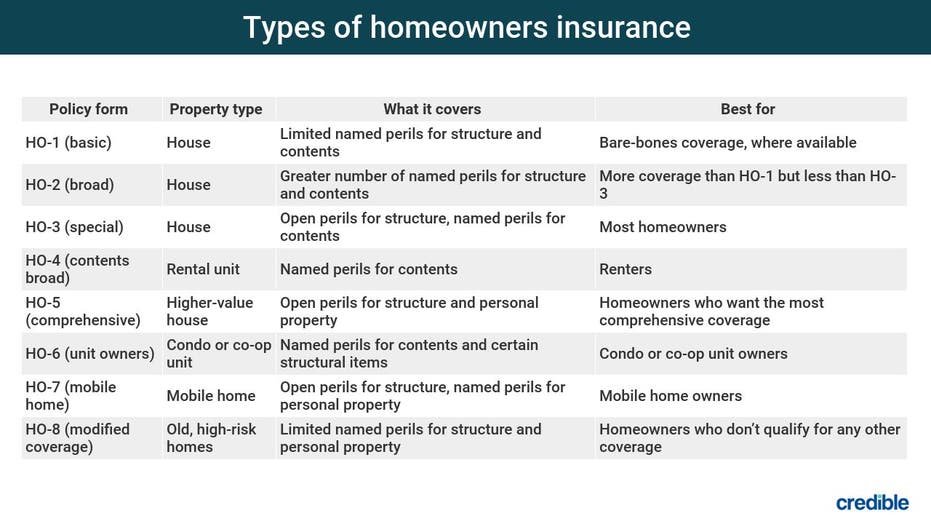

Tailoring your home insurance policy protection to fulfill your details requirements is crucial for making certain ample protection and satisfaction. When it comes to choosing the appropriate protection choices, it's crucial to think about factors such as the worth of your home, its place, contents, and any added risks you may face. By customizing your policy, you can make sure that you are appropriately secured in situation of numerous circumstances, such as natural disasters, burglary, or liability claims.One means to customize your coverage is by choosing between different types of policies, such as standard, wide, or unique form policies, depending on your specific needs. Additionally, you can choose attachments like flood insurance, quake coverage, or scheduled individual property recommendations to fill up any type of gaps in your basic policy.

Regularly examining and updating your coverage is additionally vital, particularly when substantial life adjustments take place, such as additions, purchases, or improvements. San Diego Home Insurance. By remaining aggressive and readjusting your policy as required, you can preserve extensive protection that aligns with your developing scenarios and demands

Benefits of Versatile Plans

When considering the personalization of your home insurance policy protection to match your details needs, it becomes apparent that adaptable plans use an array of beneficial advantages. Whether you need to enhance coverage due to renovations or lower insurance coverage since your children have moved out, versatile plans permit for these adjustments without significant interruptions.

Additionally, adaptable policies usually provide choices for extra coverage for details products or risks that might not be included in conventional policies. This modification can offer you tranquility of mind knowing that your distinct demands are being resolved. In addition, versatile plans usually use more control over premiums and deductibles, allowing you to locate an equilibrium that works best for your budget while still offering sufficient protection for your home and possessions. Generally, the advantages of versatile plans depend on their capability to advance with your life and offer tailored protection when you require it most.

Handling Unforeseen Situations With Simplicity

In browsing unanticipated situations easily, versatile home insurance policy policies supply a safeguard that can be adjusted to fulfill altering needs (San Diego Home Insurance). When unforeseen occasions such as natural catastrophes, break-ins, or crashes occur, having a flexible insurance plan can substantially alleviate the monetary problem and stress and anxiety connected with these events. Adaptable plans typically enable insurance holders to change insurance coverage restrictions, include endorsements for certain threats, or change deductibles as required, guaranteeing that they are appropriately shielded in different circumstancesLots of versatile home insurance alternatives offer added solutions such as click emergency situation feedback groups, short-lived holiday accommodation protection, and support for momentary repair services, enabling insurance policy holders to browse challenging situations with more self-confidence and ease. By opting for adaptable home insurance coverage strategies, individuals can better prepare themselves for unexpected occasions and handle them with better ease and durability.

Making Best Use Of Defense Through Modification

To boost the level of protecting for property owners, tailoring home insurance protection based upon private needs and scenarios confirms to be a pivotal technique. By customizing insurance plan to certain needs, homeowners can take full advantage of defense versus prospective risks that are most pertinent to San Diego Home Insurance their circumstance. Customization enables a much more accurate positioning in between the protection offered and the actual needs of the homeowner, ensuring that they are properly safeguarded in case of unanticipated events.Through modification, home owners can change coverage deductibles, restrictions, and attachments to create a plan that offers detailed defense without unneeded expenditures. Homeowners in locations vulnerable to certain natural disasters can choose for additional coverage that resolves these dangers particularly. Additionally, beneficial personal belongings such as precious jewelry or art collections can be guaranteed separately to guarantee their full defense.

Conclusion

To conclude, adaptability in home insurance permits tailored insurance coverage that can adjust to unforeseen scenarios. Personalized plans offer benefits such as making best use of defense and dealing with unforeseen occasions with convenience. San Diego Home Insurance. It is crucial to remain prepared for the unexpected by selecting insurance coverage alternatives that can be adjusted to fulfill your details demands. By picking adaptable plans, house owners can guarantee they have the protection they require when they require it most.By readjusting coverage degrees for residence, personal property, responsibility, and additional living costs, property owners can ensure they are effectively secured without paying too much for unneeded coverage.Customizing your home insurance policy protection to satisfy your details needs is important for guaranteeing sufficient security and peace of mind.When taking into consideration the personalization of your home insurance protection to match your specific needs, it comes to be evident that adaptable policies provide a range of useful advantages. Whether you require to raise protection due to improvements or reduce insurance coverage since your youngsters have relocated out, adaptable plans permit for these adjustments without significant disturbances.Furthermore, versatile policies often offer options for extra insurance coverage for certain things or threats that may not be consisted of in common plans.

Report this wiki page